Appian launches underwriting platform together with Swiss Re

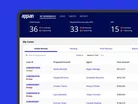

Software company Appian has launched a new product, called the Connected Underwriting Life Workbench, which it says can help insurers unify their workflows and data in a single end-to-end, automated process.

The new solution will give insurers a single interface through which to evaluate and classify risk, handle exceptions and make case decisions. It is designed to drive speed to market and reduce the amount of technical effort involved in implementation, and has been designed in partnership with Swiss Re. As such, it offers a pre-built integration with the insurance giant’s Magnum Pure underwriting solution.

The platform will leverage Appian’s existing capabilities within Generative AI and AI-led automation to enable insurers to process content quickly and at scale, while laborious tasks are automated for increased efficiency. This, in turn, will allow insurers to focus on the parts of their business that have the most impact and to enhance their competitiveness with a better underwriting experience for policyholders.

What’s more, the platform’s case management capabilities allow underwriters to spend less time on collecting information and reduce the time needed to handle exceptions – which are areas of cover that are generally included in a policy, in spite of wording that precludes certain types of events or risks from being insured.

New workbench from Appian and Swiss Re ‘a game-changer’

Jacob Sloan, Industry Vice President for Global Insurance at Appian, says: "Today's customers demand seamless digital experiences, and insurers can't afford to be held back by sluggish underwriting processes and data silos.

“Appian Connected Underwriting Life Workbench is a game-changer. It combines automation, data fabric, and plug-and-play integrations to accelerate underwriting, helping insurers avoid unprofitable risks and ensuring a superior experience for both customers and underwriters.”

Jason Render, Head Magnum Americas, Life & Health Solutions for Swiss Re, continues: "This offering is powered by Magnum, Swiss Re's automated underwriting solution, and allows business users to render point of sale underwriting decisions faster and more seamlessly, ultimately improving the experience for the end consumer. We are delighted to utilise our product innovation expertise to help bring this offering to market.”

******

For more insights from InsurTech Digital, you can see our latest edition of InsurTech Digital here, or you can follow us on LinkedIn and Twitter.

You may also be interested in our sister site, FinTech Magazine, which you can also follow on LinkedIn and Twitter.

******

BizClik is a global provider of B2B digital media platforms that provides executive communities for CEOs, CFOs, CMOs, Sustainability Leaders, Procurement & Supply Chain Leaders, Technology & AI Leaders, Cyber Leaders, FinTech & InsurTech Leaders as well as covering industries such as Manufacturing, Mining, Energy, EV, Construction, Healthcare, and Food & Drink.

BizClik – based in London, Dubai, and New York – offers services such as Content Creation, Advertising & Sponsorship Solutions, Webinars & Events.