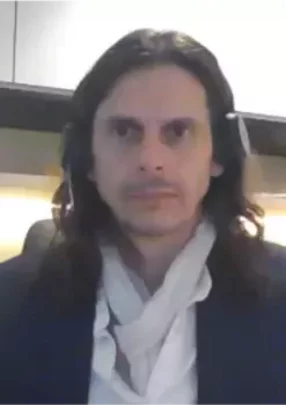

Dominique Roudaut

Chief Strategy, Innovation and Partnership Officer

Dominique Roudaut, chief strategy, partnership, and innovation officer for Hannover Re. He has more than 20 years of P&L leadership, strategic, innovation, transformation, digital, ecosystem, product, and underwriting experience at a country, regional and global level.

Hannover Re, he explains, has moved on from a pure-play Reinsurance to becoming a Reassurer, ethnographic, and data analytics provider, and ecosystem orchestrator identifying problems to solve as defined by its clients: end-users, insurers, and noninsurance distributers

“We provide resilience for end-users; customer-centricity, efficiency, and relevance for insurers, as well as pointed solutions for distributors to better enable aspects of their strategy.”

According to Roudaut, Hannover Re’s services for end-users are geared towards generating frequent engagement. The traditional insurance model where insureds pay a premium once a year and eventually get the benefit of it the day a claim occurs has proved problematic, simply because it fails to engage with the customer.

Core values

With client-centricity presenting as a core value of the company, embracing change became essential in Hannover Re’s futureproofing plans.

“We want our insureds to get something out of insurance every day with prevention services and relevant information, educating and empowering them to change their behaviour,”

Sustainability and sales

Hannover Re’s innovations have also addressed sales and claims optimisation to better improve customer centricity while alleviating pressure on the Loss Ratio and streamline insurance back-office operations.

The company’s solutions for claims revolve around fraud and First Notice of Loss with different partners for every ambition and every budget.

Another way to assess fraud and adjudicate claims is a triage mechanism powered by Clearspeed recycling and improving on a technology - notably used by defense forces in war zones to for instance hire local resources and better distinguish between an earnest translator and a potential suicide bomber

“We can also assist insurers with assessing and settling claims within minutes with a digital FNOL using the smartphone camera of an insured,” says Roudaut.

He adds, “We deliver resilience, not merely insurance. We craft experiences from A to Z.

Read the full story HERE