Climate Risk and the Home Insurance Model

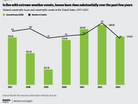

The world is warming at an unprecedented rate, with global temperatures increasing faster than at any point in recorded history. This rapid warming is altering weather patterns, leading to more extreme weather events, and disrupting the delicate balance of ecosystems. According to NASA, the planet's average surface temperature has risen by about 1.2 degrees Celsius since the late 19th century.

The World Meteorological Organisation reports that the last decade was the warmest on record, with 2020 tying with 2016 as the hottest year ever recorded.

“As climate change increases, the frequency and severity of extreme weather means insurers are exposed to storm damage, drought, floods and fires. The response has been to raise premiums, or pull out of markets altogether, further impacting the affordability and availability of home and fire insurance,” says Rory Yates, Chief Strategy Officer at EIS.

"When recent data indicated a higher flood risk than previously estimated for Austin, Texas, the cost of insurance soared. In the first half of 2023 alone, premiums rose by up to 16%.”

This trend is not isolated to the United States. Across the globe, climate change is driving up insurance costs.

“For instance, in the UK, the Association of British Insurers (ABI) reports that firms expected to pay out £219m for subsidence claims last year, the highest bill since 2006, when parts of the country experienced severe drought,” Rory notes. “As climate-related risks increase, the insurance industry is grappling with the financial fallout, impacting homeowners worldwide."

Reflecting this trend, Swiss Re also predicts that globally, homeowners insurance premiums could increase by an average of 5.3% annually, largely driven by the impacts of climate change.

The Current Insurance Model

“A major issue is that the current insurance model is prohibitive to the adaptation needed, says Rory. “The traditional model tends to focus more on compensating for losses rather than incentivising proactive risk mitigation.”

This is particularly problematic for home insurance in the context of climate change, where preventative measures could significantly reduce damage and costs.

For instance, mitigating risk has long been discussed for home insurance, especially concerning natural disasters like floods and wildfires. According to the National Institute of Building Sciences, every dollar spent on mitigation grants saves society six times that in future disaster costs. However, despite the benefits, widespread implementation of such measures has been slow.

While there are some positive examples, such as LeakBot, which aims to address the escape of water damage by detecting leaks early, these innovations are exceptions rather than the rule. LeakBot, developed by HomeServe Labs, claims to save homeowners and insurers up to US$20.52m annually by preventing water damage through early detection and intervention.

Nevertheless, little meaningful progress has been made in most other areas. For instance, only 4% of homeowners in high-risk flood areas have taken steps to protect their homes against flooding, according to a survey by the Federal Emergency Management Agency (FEMA). Similarly, a report by the Insurance Information Institute highlights that only 20% of homeowners in wildfire-prone areas have implemented fire-resistant measures around their properties.

The slow adoption of risk mitigation measures can be attributed to the prohibitive cost structure of current insurance models, which often do not provide sufficient incentives for homeowners to invest in preventative measures. For meaningful progress to be made, the insurance industry must shift towards a more proactive approach, incentivising and supporting homeowners to take preventative action against climate-related risks.

“There's hope,” says Rory. “Flood Re and others are addressing the ‘build back better’ issue with insurers.” This approach encourages rebuilding with improved materials and designs to better withstand future climate impacts. “A resilience strategy governments should be more actively supporting. If you experience flood damage, properly rebuilding the property so it doesn’t happen again makes far more sense than building back what was there before with all its incumbent risk.”

According to a report by Deloitte, the home insurance model faces unprecedented challenges. In 2022, 75% of the property and casualty sector’s insured losses, totalling US$74 billion, were linked to US homeowners. This trend is worsening, with estimated annual loss growth of 5-7%, potentially reaching US$118 billion by 2030 due to severe weather events. Addressing this, Deloitte suggests investing US$3.35bn in residential resiliency could save insurers up to US$37bn by 2030. Only 35% of US homes meet current building codes, highlighting the need for enhanced resilience measures to mitigate rising insurance costs and losses.

“A resilience strategy governments should be more actively supporting. If you experience flood damage, properly rebuilding the property so it doesn’t happen again makes far more sense than building back what was there before with all its incumbent risk,” says Rory.

There’s notable movement in the InsurTech space, which is bringing innovative solutions to the forefront of risk management and insurance. For example, FloodFlash uses Internet of Things (IoT) technology to monitor flood incursions in real-time. Their system collects and analyses data to assess flood risk and provides timely advice on actions to minimise potential damage. This approach exemplifies a relatively simple yet highly effective parametric insurance response to a significant problem.

FloodFlash’s model involves installing a sensor at the insured property, which triggers an automatic payout when floodwaters reach a predetermined depth. This system bypasses the traditional lengthy claims process, providing quick financial relief to policyholders. According to FloodFlash, the technology can reduce the average claims processing time from months to just hours, significantly benefiting homeowners and businesses alike.

So how might parametric insurance models, like those used by FloodFlash, offer more effective solutions for managing climate-related risks compared to traditional insurance models?

The growing demand and positive market reception underscore the effectiveness of such solutions. In a recent funding round, FloodFlash raised US$15 million to expand its operations, and some studies show that parametric insurance products like FloodFlash can result in claims cost savings of up to 30% compared to traditional indemnity insurance.

Long-term impacts, multi-year coverage – and you

“The challenge with most insurance, conventional or parametric, is the short-term nature of coverage,” says Martin Sarjeant, Head of Risk Solutions and Climate Risk at FIS. “Both types of insurance are great for in-policy-year protection but have limitations when it comes to the longer-term impacts from climate change.

“With home insurance, the insurer can reset the cost each year if the risk changes. At renewal, the insurer will change the rates offered in line with prior years' experiences and their perception of the current year's risks and expenses. The policyholder can also look for alternatives,” continues Martin.

As we witness an increase in climate events and climate-related claims, premiums will rise. Therefore, insurers are not really offering homeowners long-term protection against climate change or certainty in their insurance premiums (or indeed access to insurance) going forward.

“As a result, the risk of climate change on a particular property is borne predominantly by the policyholder, not the insurer, outside of the current policy year,” says Martin.

“Certainly, the conversation needs to shift to risk mitigation, and insurers should encourage consumers to mitigate these risks, but there is also a growing demand for insurers to offer more certainty with multi-year insurance. It’s a concept well understood and catered for in life insurance, for example.”

“A 'level term insurance' is normally a level premium paid over a term for a fixed/level sum insured. What that means is that if a 40-year-old takes out a 40-year level term policy, they have certainty of the premiums for the duration of the policy. At the start, the annual premium will be more than the cost of the underlying risk for the first year, but when the policyholder is 79 years old and in the last policy year, they will still pay the same annual premium they locked into at the start, which is lower than the actual risk,” says Martin.

“What we are observing with climate change is an increasing demand for homeowners to pay a level premium for multi-year coverage as well as certainty over the premiums, even though that certainty would mean the initial premiums charged would be higher than the current level, as it would be calculated based on the average expected premium over the term.

“That would begin to shift more of the risks of climate change from the policyholder to the insurer. In addition, if multi-year insurance products covering these weather events were more mainstream, then insurers would likely be more encouraged to work with policyholders, tech firms, designers, planners and construction firms to support and encourage better risk mitigation over the longer term as the pricing of the climate risks would move from being dynamically adjusted by the insurer each year (including saying 'you are now uninsurable') to the premium and risk being locked in for 5 or 10 years or more,” adds Martin.

As Rory notes, we need a lot more of these initiatives, and quickly. “Insurance markets aren’t defining the problem correctly. The challenge is bigger than simply pricing the risk. Resorting to premium increases or leaving markets entirely can’t be the only tools an insurer’s kit bag. Otherwise, we risk leaving millions of people, businesses and communities exposed.”

A paper: Misalignment between insurance rates and actual risks

The paper "Pricing of Climate Risk Insurance: Regulation and Cross-Subsidies" examines the impact of state-level price (rate) regulation on US homeowners' insurance, focusing on how insurers adjust their pricing strategies in response to climate risks. The study uses two identification strategies and unique data sets, including regulatory filings and ZIP code level rates, to explore how insurers in more regulated states handle rate adjustments compared to those in less regulated states.

The study highlights several significant aspects:

- Regulatory Frictions: States vary in their regulatory stringency, which influences how easily insurers can adjust rates. High friction states face more obstacles in rate adjustments, leading to lower frequency and magnitude of rate changes.

- Cross-Subsidisation: Insurers offset the constraints of high friction states by increasing premiums in low friction states, spreading the financial burden unevenly.

- Decoupling of Rates and Risks: Over time, the misalignment between rates and actual climate risks grows, particularly in high friction states. This decoupling results in inefficient risk distribution and potentially inadequate coverage for homeowners in high-risk areas.

- Financial Impact on Households: Homeowners' insurance premiums can constitute a significant portion of household expenses, sometimes as much as 60% of mortgage interest costs, underscoring the financial burden on families in high-risk and high-friction states.

Key findings reveal that insurers in highly regulated states adjust their rates less frequently and by smaller amounts after experiencing losses. This is due to the stringent regulatory environments that limit their ability to swiftly align premiums with the increased risk. As a coping mechanism, insurers compensate for these limitations by adjusting rates in less regulated states, effectively cross-subsidising between states. This behaviour leads to a misalignment between insurance rates and actual risks, creating distortions in risk sharing across different states.

Climate risk significantly impacts home insurance premiums through various mechanisms. Firstly, the increasing frequency and severity of natural disasters such as wildfires, hurricanes, and floods lead to higher claim payouts by insurers. These elevated payouts necessitate higher premiums to ensure the financial solvency of insurance companies. The rising cost of claims directly correlates with the premiums charged to policyholders to cover these potential future losses.

To read the full story in the magazine click HERE

**************

Make sure you check out the latest industry news and insights at InsurTech and also sign up to our global conference series - Tech & AI LIVE 2024

**************

InsurTech is a BizClik brand

Featured Articles

Clearwater has expanded its capabilities through the strategic purchase of Beacon, aiming to unify front-to-back office processes for institutional client

Insurwave partners with Osprey to deliver unified security insights for underwriters amid rising global tensions

Danish government creates state-backed buffer as commercial markets face geopolitical pressures amid rising maritime tensions